Typical Home Mortgage Questions Responded To In This Article

Written by-Dahl BynumMortgages are powerful tools. Having one lets you have your own home and live in it for years before you actually own it by yourself. That power comes at a price however, as mortgages are tricky to get and a burden to live with. Use the ideas and advice in the following paragraphs to ease this stress in your life.

Make sure you have a steady work history before applying for a mortgage loan. A two-year work history is often required to secure loan approval. Job hopping can be a disqualifier. Do not quit https://www.gobankingrates.com/banking/banks/how-to-open-a-citibank-account/ while you are involved in the mortgage loan process.

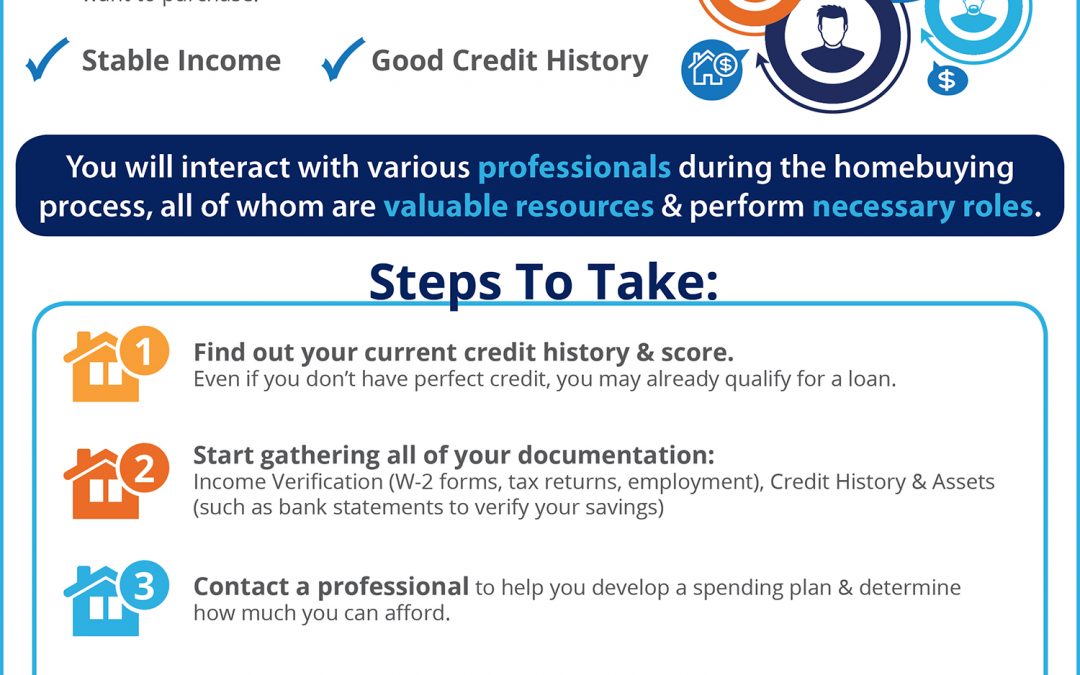

If you are planning on purchasing a house, make sure your credit is in good standing. Most lenders want to make sure your credit history has been spotless for at least a year. To obtain the best rate, your credit score should be at least 720. Remember that the lower your score is, the harder the chances of getting approved.

Work with your bank to become pre-approved. Pre-approval helps give you an understanding of how much home you can really afford. It'll keep you from wasting time looking at houses that are simply outside of your range. It'll also protect you from overspending and putting yourself in a position where foreclosure could be in your future.

Even if you've been denied by a mortgage company, there are many other places to find one. Just because one company has given you a denial, this doesn't mean they all will. Keep shopping around and looking for more options. Get a co-signer if you need one.

For the house you are thinking of buying, read up on the past property taxes. You should know how much the property taxes will cost. The tax assessor may consider your property to be more valuable than you expect, leading to an unpleasant surprise at tax time.

Look into no closing cost options. If closing costs are concerning you, there are many offers out there where those costs are taken care of by the lender. The lender then charges you slightly more in your interest rate to make up for the difference. This can help you if immediate cash is an issue.

Stay persistent with your home mortgage hunt. Even if you have one lender rejects you, it doesn't mean they all will. Many tend to follow Freddie Mac and Fannie Mae's guidelines. They may also have underwriting guidelines. Depending on the lender, these may stricter than others. You can always ask the lender why you were denied. Depending on the reason they give, you can try improving your credit quickly, or you can just go with a different lender.

Do not allow yourself to fall for whatever the banks tell you about getting a home mortgage. You have to remember that they are in the business of making money, and many of them are willing to use techniques to suck as much of that money out of you that they can.

Choose your mortgage lender many months in advance to your actual home buy. Buying a home is a stressful thing. There are a lot of moving pieces. If you already know who your mortgage lender will be, that's one less thing to worry about once you've found the home of your dreams.

Some financial institutions allow you to make extra payments during the course of the mortgage to reduce the total amount of interest paid. This can also be set up by the mortgage holder on a biweekly payment plan. Since there is often a charge for this service, just make an extra payment each year to gain the same advantage.

Before you apply for a mortgage, know what you can realistically afford in terms of monthly payments. Don't assume any future rises in income; instead focus on what you can afford now. Also factor in homeowner's insurance and any neighborhood association fees that might be applicable to your budget.

Think about your job security before you think about buying a home. If you sign a mortgage contract you are held to those terms, regardless of the changes that may occur when it comes to your job. For example, if you are laid off, you mortgage will not decrease accordingly, so be sure that you are secure where you are first.

Be sure you understand all fees and costs related to any mortgage agreement you are considering. Make certain all commission fees, closing costs and other charges are itemized. You can often negotiate these fees with either the lender or the seller.

Think about finding a mortgage that will let you make bi-weekly payments. Doing this allows you to make two extra payments each year, which can greatly reduce the amount that you pay in interest over the term of the loan. It is also ideal if you get paid every two weeks, as you can have the payment automatically draw from your bank account.

Think about getting a mortgage that lets you pay every 2 weeks. When you do this, it lets you make a few more payments a year. You might even have the payment taken out of your bank account every two weeks.

Pay your mortgage down faster to free up money for the future. Pay a little extra each month when you have some extra savings. When https://www.ft.com/content/95898e54-9975-4eff-bf97-298f3d67ef61 pay the extra each month, make sure to let the bank know the over-payment is for the principal. You do not want them to put it towards the interest.

Be prompt about getting your documentation to your lender once you have applied for a home mortgage. If your lender does not have all the necessary documentation on hand, and you have begun negotiations on a home, you could end up losing lots of money. Remember that there are nonrefundable deposits and fees involved, so you must get all your documentation submitted in a timely manner.

Most people would never get to live in their own home without a mortgage. Mortgages give you the chance to pay for your home while you enjoy it over many years. Still, that's a long time to live with that obligation, even after you went through the stress of getting the mortgage. Apply what you have learned from this article to minimize your mortgage stress.